By Ally Nemetz, Director, Customer Service and Data Administration

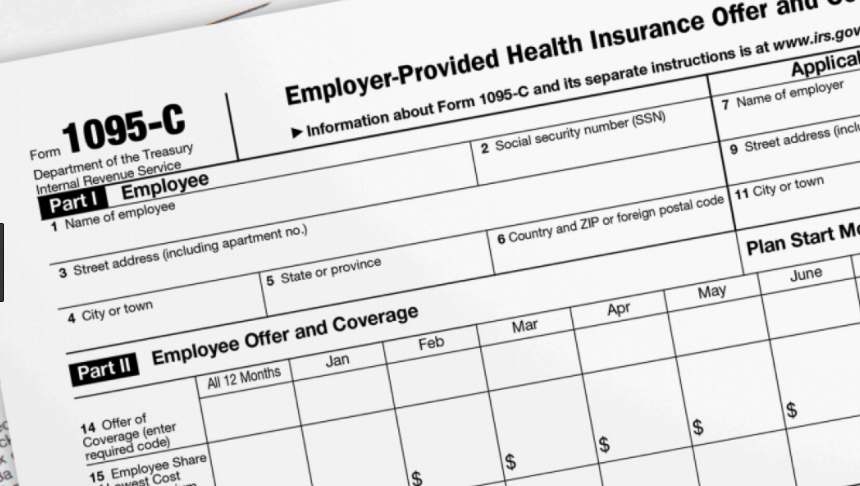

The IRS extended the deadline to send IRS Form 1095 to employees to March 2, so insurance carriers and employers with self-funded health insurance plans need to act fast.

Employers must prepare and send the tax form, which is required by the Affordable Care Act (Obamacare), to full-time employees (those who work an average of 30 or more hours per week) or to employees who were enrolled in a health plan for any month in 2017.

Although we are in the third year of this requirement, there are still many employees who are unfamiliar with the IRS Form 1095. If you have any questions, please contact Ally Nemetz at (800) 366.3699, ext. 350.

New individual IRS requirement for reporting health coverage

Beginning with the 2018 reporting year, the IRS will not accept individuals’ returns if they are missing the health coverage information on their 2017 federal tax returns. In October 2017, the Internal Revenue Service (IRS) released guidance that individuals must now answer questions about health coverage on their federal tax return.

For the 2018 reporting year, individuals must indicate whether they had:

• Minimum essential coverage (MEC) for the year;

• Qualified for an exemption from having health coverage; or

• Are paying the individual shared-responsibility payment.

The 2017 tax year is the first time the IRS will not accept tax returns that do not include the above information.

If individuals do not provide the information:

• Electronic returns will not be accepted until the information is provided.

• Paper returns may be suspended and any refund delayed until the IRS receives the additional information.

Employers may want to make sure their employees are aware of their need to fully complete their tax return with the MEC information. Although those filing taxes are not required to attach the 1095 Form to their federal tax return, it is possible the employee or tax preparer will be looking for the 1095-B or 1095-C form to prepare their tax return.

There is a line on the 1040 Tax Return, line 61 and line 11 on the 1040EZ Form, that will ask about health care. This is also known as Individual Shared Responsibility Provision. As mentioned above, your tax preparer may ask you for a copy of your 1095 Form. It is not necessary to send the IRS a copy of your 1095 Form along with your tax papers. You can file your taxes at any time even if you haven’t yet received your 1095 Form. Just make sure to properly answer the Individual Responsibility question.

2018 changes that affect small groups

Under new guidelines in the Affordable Care Act, the age band rating for children, which affects premiums, has been changed from 0-18 to 0-14. This change was made to better reflect the health risk of children, which affects the rates, and to provide a more gradual transition as children age.

What this means to you:

• In 2018, there will be one age band for children between ages 0-14.

• After age 14, there will be single-year age bands that have increasing age factors until an individual reaches age 21, at which time the age factor is 1.

The change took effect Jan. 1 for new groups or will start at your 2018 rate-renewal.