by William J. Hallan, Executive Vice President, Chief Operating Officer and General Counsel

Congratulations! Your start-up business is growing and you’re considering expanding your workforce beyond yourself.

You may be wondering whether you need to obtain workers’ compensation insurance to cover your new worker or workers.

Don’t worry, Retailers Insurance Company is here to help answer your questions!

Workers’ compensation insurance was developed to create a remedy for employees that were injured on the job. Prior to 1912, an injured employee would have to sue his or her employer and prove that the employer was negligent – a difficult task.

Under the Michigan Worker’s Disability Act (the “Act”), a compromise was achieved: workers gave up the right to sue but earned the right to recover for workplace injuries, no matter who was at fault.

Employers benefited because the Act limits damages to certain wage loss benefits, medical treatment and rehabilitation.

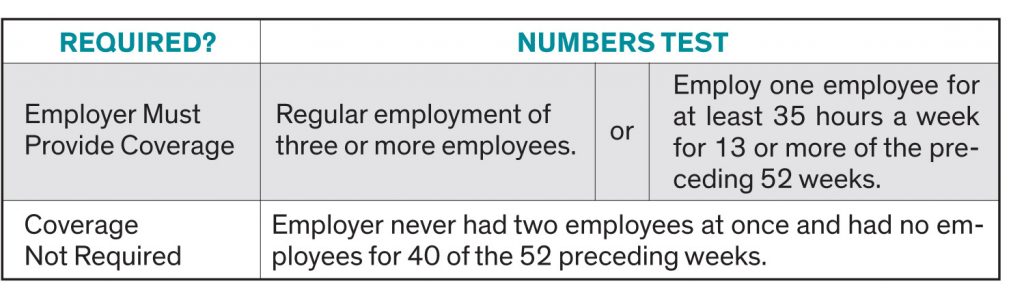

The “simplest” way for an employer to determine whether it must provide workers’ compensation coverage is to count the number of its employees.

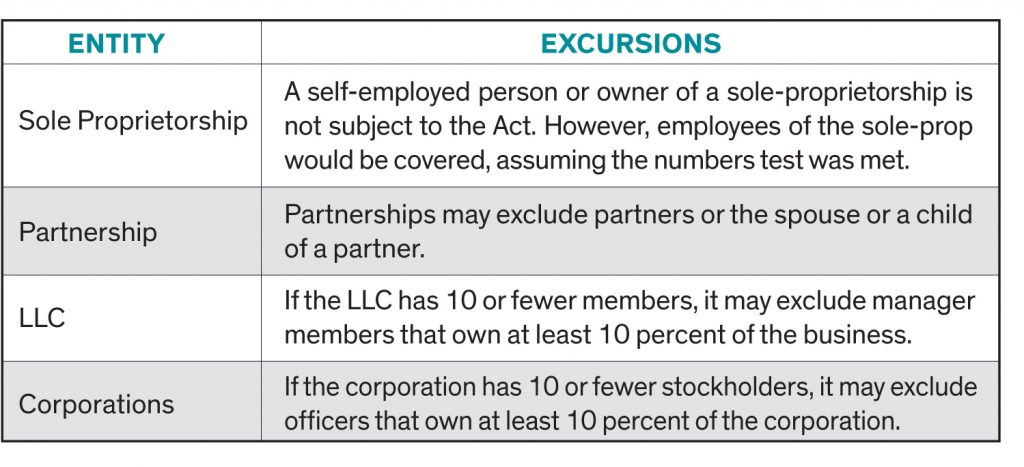

Even if coverage is required by the numbers test, the Act does allow for certain exclusions.

Even if coverage is required by the numbers test, the Act does allow for certain exclusions.

It should be noted that appropriate corporate action (e.g., board resolution) is required by the legal entity to properly exclude an individual.

It should be noted that appropriate corporate action (e.g., board resolution) is required by the legal entity to properly exclude an individual.

Because the numbers test is fairly straightforward, it is not the source of most coverage confusion. More likely, it’s the nature of the employer-employee relationship that raises questions.

For instance, is the individual an independent contractor? A volunteer?

The procedure for determining whether an individual is an employee changed on January 1, 2013, though the change didn’t necessarily make the process easier.

The law now requires the application of a multi-factor test, the purpose of which is to determine whether the employer has the right to control the employee (e.g., ability to control when, where and how the work is done, whether full-time work is required, whether a continuing relationship exists).

Employers should examine all of their relationships so they can properly determine which individuals are covered. An employer also may request a determination from the Michigan Administrative Hearing System.

Limiting Liability

Even if an employer is not covered by the Act or required to provide coverage, an employer may voluntarily choose to provide coverage. Why?

Workers’ compensation coverage is a way of limiting liability. When coverage is provided, the insurance benefits become the employee’s exclusive remedy against the employer for injuries or diseases that arise in the course of employment.

The only exception to that exclusive rule is a high standard and is triggered only if the employer acted deliberately and intended for an injury to occur (i.e., the employer had knowledge that the employee was likely to be injured and willfully disregarded that knowledge).

If you’ve determined that you need coverage, Retailers Insurance Company can help.

We provide workers’ compensation insurance to more than 1,300 businesses of many different types – not just retailers – in Michigan. Included with our coverage are some of the highest limits of employers liability, plus EFT Guard protection (protects against online business banking theft).

Contact your independent agent to get a quote or visit www.retailersinsurance.com

to find a Retailers Insurance agent near you.