*This post will be continuously updated as more information becomes available – please check back for more updates and information*

Last updated 5/3/20 at 7:00 pm

On March 10, Gov. Whitmer declared a state of emergency via Executive Order 2020-4 in Michigan when two cases of Coronavirus were confirmed in Michigan residents. See daily updates on the number of new, positive COVID-19 cases and deaths here.

What’s new:

Please note, state and federal guidance is evolving, so the information may change. New items are noted with bold, red type with the date they were added. You can also see a running list of updates by date in this section.

- Stay Home Order extended through May 15

- Executive Order 2020-71 extends and replaces Gov. Whitmer’s previous Stay Home, Stay Safe order (E.O. 2020-42 and E.O. 2020-59) that was set to expire on April 30. The new order extends through 11:59 p.m. on May 15. This order must be construed broadly to prohibit in-person work that is not necessary to sustain or protect life.

- The new order specifically allows previously closed retailers to now offer retail-to-go remote sales of all products if it’s done via delivery or curbside.

- The new order also reopens previously closed sections of the store including garden centers, paint, furniture and flooring sections.

- Garden centers, nurseries, landscapers, lawncare, moving, storage, bicycle maintenance and repair work, maintenance and pest control operations may reopen or start operating under the order. They must limit in-person interaction with customers and provide protective gear to employees such as gloves, goggles, face shields, and face masks as appropriate for the activity being performed. Garden centers and nurseries must ensure proper 6-foot social distancing can occur and bar any gathering points that would otherwise occur.

- All businesses that have employees performing in-person work to provide employees with at least cloth face coverings by 11:59 p.m. on Sunday, April 26.

- Attorney General Nessel subsequently issued a statement asking law enforcement officers to be lenient in issuing misdemeanor charges against businesses who do not immediately comply if they have made a good faith effort to acquire masks for their workers.

- It also requires anyone able to medically tolerate a face covering to wear one covering their nose and mouth (such as a homemade mask, scarf, bandana, or handkerchief) when in any enclosed public space.

- Stores are not expected to enforce this requirement and the governor stated no citations would be issued to individuals for noncompliance.

- Stores may refuse to serve anyone or allow them to enter if the person is not wearing a face covering but should be conscious of the medical exceptions and potential lawsuits if they do not accommodate those with medical conditions.

- Open businesses must also develop a COVID-19 preparedness and response plan consistent with recommendations in Guidance on Preparing Workplaces for COVID-19, developed by the Occupational Health and Safety Administration and available here. Such plan must be available at company headquarters or the worksite.

- Stores selling groceries, medical supplies (pharmacies), fuel, pet supplies, auto supplies, appliances, hardware items and home maintenance products must continue following the previously required capacity limits, social distancing markers, and requirements to maintain lines outside the store.

- COVID-19 testing expanded to all essential workers

- Starting April 20, the state announced all essential workers still reporting to work in person, regardless of whether they’re demonstrating symptoms, are now eligible for COVID-19 testing. This includes retail grocery workers, pharmacy workers, and hardware store workers among others.

- The testing is subject to availability and employers should calling ahead to testing sites before sending employees.

- Employees should not need to verify they are essential workers to receive testing, but it may be a best practice to have them take the written verification they received stating they were essential (this can be as simple as printing off the information if posted on an employer’s website and showing an employee badge or uniform.)

- A list of testing site locations is available on the state’s website.

- Workers who plan to utilize the drive-through testing at the State Fairgrounds in Detroit (located near the Detroit Zoo) will need a code obtained by the employer. Employers can get a code by calling 313-230-0505.

- A memo with more information on worker testing is available here.

- Food establishments and pharmacies must meet new requirements under E.O. 2020-60 (updated to E.O. 2020-71)

- All food-selling establishments (grocery stores, convenience stores, and restaurants) and pharmacies must follow additional cleaning, mitigation and employee screening efforts under E.O. 2020-71. The order took effect April 26 and runs through May 22. The full list of requirements is here.

- The order also extends the food establishment license deadline from April 30 until 60 days after the end of the declared states of emergency and disaster.

- City of Detroit requires grocery worker testing

- Mayor Mike Duggan announced on April 24 his intent to require all grocery store operating in the City of Detroit to have all of their workers tested for COVID-19 before May 11. If stores can not show that their workers have been tested Mayor Duggan said he would consider closing stores. No formal order was issued and it appears the Mayor came out strong in a press conference but intends to work with stores to get their employees tested instead of being overly punitive.

- Pandemic EBT

- The State of Michigan was approved for Pandemic EBT benefits for children who receive free/reduced school meals. Families already receiving SNAP benefits will receive those March/April benefit increases of $193.80 per child on their current SNAP EBT card this week.

- The state will also start issuing benefits for those children who are receiving free/reduced school meals by May 8. The second round, valued at $182.40 per child will be issued for May/June by the end of May.

- The state estimates it will issue about $147 million in benefits for March/April and about $163 million for May/June. The benefits can be used over 12 months and have been instructed to do so.

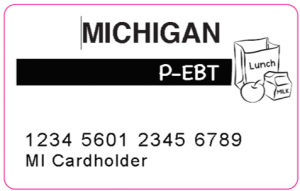

- Retailers should be aware, that the alternative SNAP/EBT cards do not all have the Bridge logo on the front but may instead list P-EBT on them. These new cards are valid and customers with the new cards may need some guidance on how to use EBT benefits for the first time.

- Legislative schedules/meetings:

- The House and Senate met at 10 a.m. on March 25, April 7 and April 24.

- Legislators came into town specifically to approve a resolution on April 7 extending Gov. Whitmer’s powers to issue emergency orders through April 30.

- The House and Senate revised its schedule to meet at 10 a.m. on April 28, April 29 and April 30 and will continue meeting regularly based on its normal Tuesday-Thursday schedule going forward.

- A special session of the House and Senate was called on April 24. A COVID-19 task force was created to “examine the status and efficacy of governmental actions” in response to the COVID-19 pandemic and then issue a report on its findings to the Legislature, which can take any actions it deems necessary. The committee will have subpoena power to require any state department, board, institution, or agency to produce any documents they request.

- House Committee members include Rep. Matt HALL (R-Emmett Twp.) chair, Rep. Julie CALLEY (R-Portland), Rep. Jack O’MALLEY (R-Lake Ann), Rep. Vanessa GUERRA (D-Saginaw) and Rep. Tyrone CARTER (D-Detroit).

- Senate committee members include Aric NESBITT (R-Lawton) chair, Sen. Kim LaSATA (R-Bainbridge Twp.), Sen. Wayne SCHMIDT (R-Traverse City), Sen. Curtis HERTEL (D-East Lansing) and Sen. Adam HOLLIER (D-Detroit).

- Legislators came into town specifically to approve a resolution on April 7 extending Gov. Whitmer’s powers to issue emergency orders through April 30.

- The House and Senate met at 10 a.m. on March 25, April 7 and April 24.

- Work share program updates

- Executive Order 2020-57 gives more flexibility on the Work Share program, allowing the state to approve an employer’s participation in the program upon application, regardless of whether they meet the statutory requirements. This change will allow more employers to participate in the Work Share program on a temporary basis.

- Specifically, it allows employers more flexibility on the number of hours that can be reduced. Previously, the Work Share program allowed an hourly reduction between 15 and 45 percent. Executive Order 2020-57 now allows a reduction between 10 and 60 percent.

- Executive Order 2020-57 gives more flexibility on the Work Share program, allowing the state to approve an employer’s participation in the program upon application, regardless of whether they meet the statutory requirements. This change will allow more employers to participate in the Work Share program on a temporary basis.

- Stay Home Order extended through April 30

- Executive Order 2020-42 extended and replaced Gov. Whitmer’s original Stay Home, Stay Safe order that expired on April 14. The new order went into effect on April 9 at 11:59 p.m. and extends through 11:59 p.m. on April 30. It requires individuals to limit, to the maximum extent possible, the number of household members who leave home for errands. It includes the following limitations on critical infrastructure retailers that are allowed to remain open:

- Capacity limits:

- Stores under 50,000 square feet of customer space: 25% of fire marshal occupancy limits including employees in the total count (including employees).

- Stores over 50,000 square feet of customer space: 4 customers per 1,000 square feet of floor space (does not include employees).

- Requires all stores to implement lines with markers outside the store ensuring social distancing and encourages adding alternate methods to notify seniors and disabled individuals when they can enter (via a text or call feature).

- The order also specifically allows the DHHS director to issue an emergency order varying the capacity limits for small and large stores.

- “Nonessential” sales in stores over 50,000 square feet:

- Requires the closure of certain areas of the store (carpet/flooring, furniture, garden centers and plant nurseries, and paint). These areas may be closed via cordoning them off, placing signs in aisles, posting prominent signs, removing goods from shelves or other appropriate means.

- By April 13, it prohibits advertising/promoting nonessential items that are not groceries, medical supplies, or items necessary to maintain the safety, sanitation, and basic operations of residences.

- Special shopping hours required in stores over 50,000 square feet:

- Requires stores to provide at least two hours per week of dedicated shopping hours for vulnerable populations (people over 60, pregnant women, and those with chronic conditions like heart disease, diabetes, and lung disease).

- Oakland County requires retail workers to utilize face coverings

- Oakland County issued Emergency Order 2020-07 that took effect April 14 at 12:01 a.m. requiring all essential service employees who have face-to-face contact with customers or workers who handle items that will be purchased, such as grocery store workers to wear face coverings (these should not be N-95 or surgical masks). The new order rescinds the previous Emergency Order 2020-05.

- NOTE: Several county health departments have extended emergency orders that require employers to pre-screen employees for potential COVID-19 symptoms and travel. See the heading toward the bottom of this page Employee screening/social distancing requirements for new and updated county orders.

- City of Flint implements curfew (added 4/16/20)

- Between April 2-May 1, the City of Flint is under a curfew prohibiting travel on county of local highways between 9:00 p.m. to 6:00 a.m. Violations are a misdemeanor.

- Exemptions exist for traveling to/from grocery stores, gas stations, banks, pharmacies, and doctors’ offices. It also exempts workers who are directly involved in providing or obtaining essential services as described in the Governor’s Stay Home order.

- For more information see the City of Flint’s Executive Order 20-003.

- Lottery sales distancing requirements and deactivation information

- Retailers are not required to sell lottery products and may request deactivation of equipment at any time. There are no penalties for deactivation. To deactivate, call 517.335.5619 or email msl-licensing@michigan.gov.

- Stores that are unable to implement social-distancing measures and follow all requirements of the stay home, stay safe order must deactivate their lottery terminals.

- Recommended cleaning procedures for touchscreen equipment.

- MDARD Requests: allowing bulk order for certain licensed facilities and Food Bank donations

- MDARD is asking retailers to consider making exceptions to limits on buying product in bulk for certain customers if they’re shopping on behalf of a care facility like a group care facility or adult youth facility. MDARD reported that these shoppers are often bringing the license in with them as proof.

- MDARD is also desperately looking for donations to Food Banks that are all running low on product (this was shared with larger retailers and suppliers last week).

- State and MLCC approve spirits buyback program for on-premises liquor licensees

- Pursuant to Gov. Whitmer’s Executive Executive Order 2020-46, beginning April 14, on-premises liquor licensees whose businesses are affected by Executive Orders related to the continuing COVID-19 health crisis, may submit a request to the Michigan Liquor Control Commission to participate in a spirits buyback program for financial relief.

- Specific details about the program, including an application form and detailed inventory form are available on the Commission’s website at michigan.gov/lcc. Completed forms must be submitted by Friday, April 17, 2020 at 5:00 pm. Requests submitted or postmarked after that time will not be accepted.

- Liquor license renewal extended to May 31, 2020

- Because of the Coronavirus (Covid-19) state of emergency, the Liquor Control Commission voted to extend the expiration date of liquor licenses in 2020 from April 30, 2020 to May 31, 2020. This action was taken by the Commission on March 13, 2020 when it approved Administrative Order 2020-05, pursuant to MCL 436.1501(2).

- This will allow licensees an additional month to submit their renewal applications and renewal payments. Renewals were mailed to all licensees the first week of March.

- Licensees are encouraged to renew their licenses online via electronic funds transfer to ensure the fastest processing of their applications. The online renewal portal is open 24 hours a day, 7 days a week. Licensees may renew online by clicking here.

- OSHA releases new COVID-19 enforcement plan

- On April 13, the U.S. Department of Labor’s Occupational Safety and Health Administration (OSHA) announced an interim enforcement response plan for the coronavirus pandemic that provides instructions and guidance to OSHA Area Offices and compliance safety and health officers (CSHOs) for handling coronavirus-related complaints, referrals, and severe illness reports.

- During the coronavirus outbreak, OSHA Area Offices will utilize their inspection resources to fulfill mission essential functions and protect workers exposed to the disease. The response plan contains interim procedures that allow flexibility and discretion for field offices to maximize OSHA’s impact in securing safe workplaces in this evolving environment

- Self-employed workers can file for unemployment as of Monday, April 13

- The Michigan Unemployment is now accepting applications from self-employed workers. Newly eligible for federal Pandemic Unemployment Assistance (PUA) include self-employed workers, gig workers, 1099-independent contractors and low-wage workers affected by COVID-19.

- These workers will receive their state benefit amount (paid with federal funds) and the $600 federal payment as early as April 20.

- The UIA will be accepting applications back-dated to reflect the date on which the claimant was laid-off due to COVID-19, beyond the previously established 28-day period ($600 federal payment is only retroactive back to March 28).

- How to receive these benefits:

- Workers who have previously applied for unemployment benefits and have been denied should login to their MiWAM account to complete the next steps (check your email for details from UIA) for PUA federal benefits. They should not file a new claim, as that may delay the time it takes to get their benefits.

- All newly eligible workers will need to provide proof of income to receive the maximum amount they are entitled. This could include W-2s, 1099 tax forms, and pay stubs. New filers should begin receiving federal benefits as early as April 20 after their bi-weekly certification.

- Individuals on paid sick leave or other paid leave – and those who have the ability to telework with pay – are not eligible for PUA.

- Applicants are encouraged to file online at gov/UIA. Workers need to use the UIA’s daily filing schedule based on their last names (see below).

- Last names beginning with letters A-L: file claims on Mondays, Wednesday, Fridays.

- Last names beginning with letters M-Z: file claims on Sundays, Tuesdays, or Thursdays.

- Saturdays will be available for anyone to accommodate those who could not file during their allotted window.

- Payroll Protection Program

- Small businesses and sole proprietorships could apply as of April 3. Independent contractors and self-employed individuals can apply as April 10.

- The program ran out of funds on April 16. MRA joined other business groups are encouraging Congress to approve more funding for PPP loans.

- Helpful resources for applicants and borrowers:

- Employee screening/social distancing requirements

- Alcona, Iosco, Oscoda, Ogemaw order (with record-keeping requirements)

- Alpena, Cheboygan, Montgomery, and Presque Isle Counties order (with record-keeping requirements)

- Antrim, Charlevoix, Emmet & Otsego Counties (with record-keeping requirements)

- Barry-Eaton Counties recommended screening tool

- Bay County order

- Saginaw County order

- Loans, loan guarantees and investments under the CARES Act:

- Under the CARES Act signed into law on March 27, the U.S. Treasury Secretary is permitted to make loans, loan guarantees and investments in an amount not to exceed $500 billion.

- The Paycheck Protection Program is intended to promote the retention of employees by providing funds for short term expenses.

- Available to businesses with fewer than 500 employees and in an amount not to exceed 250% of average monthly payroll.

- Loans are eligible for forgiveness to the extent the money is used for payroll, rent, utilities and mortgage interest obligations. Loan repayments can also be deferred for a period of time.

- The eligible loan period is retroactive to February 15, 2020 through June 30, 2020.

- There are certain prohibitions when taking advantage of these loans. These include prohibitions on stock buybacks and dividends, unless there is already an existing agreement or contract in place, and limits on executive compensation during the term of the loan plus a period of time thereafter.

- The loans will be guaranteed by the Small Business Administration and will likely be issued by most FDIC insured banks. Retailers wishing to take advantage of these loans should be in contact with an appropriate lending institution to inquire about the application process.

- For more information view our full post on the Federal CARES Act Includes Key Provisions for Retailers.

- Business tax relief under the CARES Act:

- Employers may now defer 50% of 2020 employer payroll taxes until December 31, 2021, with the remaining 50% due December 31, 2022.

- 50% refundable payroll tax credit for employers who had their business fully or partially suspended.

- Net operating losses from 2018, 2019 and 2020 can be carried back to the previous five years to offset taxable income. This will generate an immediate rebate on taxes already paid.

- Businesses will now be able to deduct 50% of interest expenses from 2019 and 2020 (up from the current 30%).

- Remodeling projects done by retailers and restaurants in 2018 and 2019 can be depreciated more quickly on an amended tax return. Those overpayments will be refunded because the CARES Act corrected a previous tax reform glitch that impacted the depreciation period for improvements.

- For more information view our full post on the Federal CARES Act Includes Key Provisions for Retailers.

- Employee screening/social distancing requirements

- Emergency Paid Sick Leave and Emergency FMLA

- The acts provisions will take effect on April 1.

- Employers are only eligible for tax credits for payments to employees beginning on April 1.

- See additional information from the Department of Labor: Families First Coronavirus Response Act FAQs.

- The act also includes a new posting requirement. The poster can be found here: Employee Rights Paid Sick Leave and Expanded FMLA under the Families First Coronavirus Response Act.

- Employers with employees teleworking or working from home are encouraged to post the notice on their website and/or send it to employees via email.

- The acts provisions will take effect on April 1.

- Unemployment

- Additional federal unemployment benefits:

- Additional federal benefits will be in effect until Dec. 31, 2020 to help workers impacted by COVID-19.

- Benefit payments are extended from 26 weeks to 39 weeks.

- Supplements standard payments by $600.00 per week.

- It also provides payments to those not traditionally eligible for unemployment benefits, including self-employed individuals, who are unable to work as a direct result of the coronavirus public health emergency.

- Additional federal benefits will be in effect until Dec. 31, 2020 to help workers impacted by COVID-19.

- Under an updated Executive Order on unemployment benefits (Executive Order 2020-24 that replaces E.O. 2020-10):

- Businesses won’t be charged if an employee becomes unemployed or is placed on temporary leave. It will instead be charged to the Unemployment Insurance Agency’s non-chargeable account. (added 3/29/20)

- Effective March 25, 2020 at 11:59 pm, the benefits conferred on employers by this section are not available to employers determined to have misclassified workers.

- E.O. 2020-24 is in effect through April 22.

- Additional federal unemployment benefits:

- Work Share program

- Specific guidance from the State of Michigan related to utilizing the Work Share program related to COVID-19 is available here.

- Temporary leave unemployment form

- A notice employers should provide to employees related to temporary layoffs that will be needed to file for unemployment benefits is available here.

- Employee screening/social distancing requirements

- Several county health departments have adopted orders that require employers to pre-screen employees for potential COVID-19 symptoms and related travel. If any employee has symptoms and/or has traveled, they may not work and must stay home for 3-14 days (depending on which criteria they meet). The orders also require employers to adopt social distancing standards. This list is changing regularly but here are the counties with employee health/travel screening orders we’re aware of. Please note, these are all slightly different and should be read carefully to ensure compliance.

- Ingham County order

- Ionia County guidance

- Kent County guidance

- Oakland County order

- Washtenaw County order

- Wayne County order (see order 20-01 on this page)

- Several county health departments have adopted orders that require employers to pre-screen employees for potential COVID-19 symptoms and related travel. If any employee has symptoms and/or has traveled, they may not work and must stay home for 3-14 days (depending on which criteria they meet). The orders also require employers to adopt social distancing standards. This list is changing regularly but here are the counties with employee health/travel screening orders we’re aware of. Please note, these are all slightly different and should be read carefully to ensure compliance.

- IRS tax filing delay

- U.S. Treasury Secretary Steven Mnuchin announced on March 17 that the IRS will delay collection of tax payments 90 days for individual taxpayers with up to $1 million in payments and businesses with up to $10 million in payments.

- On March 21 the IRS extended the filing and payment deadline to all taxpayers from April 15 to July 15.

- State of Michigan tax filing delay

- The State of Michigan extended tax filing deadlines from April 15 to July 15 to match the revised federal deadline.

- For more information see Executive Order 2020-26.

- Stay at home order guidance for employers from the state on what is and isn’t considered critical infrastructure.

- Oakland County Stabilization Fund for Small Businesses

- Small business owners with 100 or less employees in Oakland County can apply for either grant or loan funding.

- To be eligible for either the grant or loan, the business must have experienced significant financial hardship as a result of the COVID-19 outbreak or related state executive orders.

- Small businesses can view the eligibility criteria on Oakland County’s website.

- Pharmacy

- Eased restrictions on pharmacists, increasing access to prescriptions

- On March 25, Gov. Whitmer signed Executive Order 2020-25 to allows emergency refills up to 60 days and permits out-of-state pharmacists/pharmacies to do business in Michigan by honoring other state licenses.

- It is effective through April 22.

- Medicaid early refill, signature requirements lifted

- Medicaid-specific pharmacy requirements have been lifted regarding signatures and early refills (including override information).

- For more information see the memo sent to pharmacy providers from MDHHS here.

- Eased restrictions on pharmacists, increasing access to prescriptions

- WIC substitutions

- Michigan WIC issued vendor guidance on substitutions (temporary WIC Food Expansion) that will be allowed as of April 1. MRA shared the approved substitution list with members early. (added 3/29/20)

- SNAP supplemental benefits

- Michigan was approved for additional benefits and customers will have those benefits available to them starting March 27 with staggered distribution through the week of March 30. A similar distribution is slated to happen at the end of April.

- Michigan Liquor Control Commission releases Frequently Asked Questions For Liquor License Businesses During Coronavirus (Covid-19) State of Emergency

- Non-essential, stay at home order issued for March 24 – April 13

- The administration recommends that businesses read the order carefully and consult with their legal counsel on whether or not they are permitted to remain open and what functions they may continue.

- While we cannot provide legal advice on whether your specific business can stay open, we can steer you in the right direction. The Governor listed the types of qualifying sectors in her Executive Order and also referenced guidance from the Director of U.S. Cybersecurity and Infrastructure Security Agency. Both of those documents are linked below and should help you in making your determination.

- See the state’s frequently updating FAQs for more guidance.

- Guidance from the Director of U.S. Cybersecurity and Infrastructure Security Agency

- Bottle returns under Michigan’s bottle deposit law considered nonessential

- The governor’s office clarified that they do not consider bottle and can returns under the state’s bottle deposit law an essential service under Executive Order 2020-21.

- Grocers can temporarily stop accepting bottle and can returns as of March 24 – April 13.

- The state has indicated that the FAQs on E.O. 2020-21 will be updated soon to include clarification in writing.

- MRA requested the state follow Connecticut, Iowa, Maine, Massachusetts, Oregon and Vermont’s lead and suspend its enforcement of the bottle deposit law to allow workers to focus on providing essential services and avoid contamination from surfaces that may be harboring the coronavirus.

- Federal government (FMCSA) has waived the expiration date for CDL (Commercial Drivers License) and CLP (Commercial Learners Permit) holders until June 30.

- Many drivers have experienced issues with obtaining access to state licensing offices and to medical examiners to obtain the required physical.

- The waiver extends the date of expiration – until June 30 – of applicable CDLs, CLPs, and non-CDL licenses of commercial drivers, as well as medical certificates that would otherwise expire between March 1 and June 30.

- The waiver can be found here.

- Non-essential, stay at home order issued for March 24 – April 13

- On March 23, Gov. Whitmer issued an order urging residents to stay at home unless they deemed an essential worker or need to obtain necessary supplies.

- There is an exemption for people “to obtain necessary services or supplies for themselves, their family or household members, and their vehicles. Individuals must secure such services or supplies via delivery to the maximum extent possible. As needed, however, individuals may leave the home or place of residence to purchase groceries, take-out food, gasoline, needed medical supplies, and any other products necessary to maintain the safety, sanitation, and basic operation of their residences.”

- Notifications:

- Businesses considered critical infrastructure can designate their suppliers and others needed to supply goods and materials for sale, clean, etc.

- Businesses should send those designated entities a letter telling them they are critical to your business and able to operate.

- Employees must be notified if they are considered essential. That can be done verbally through March 31, and then must bet put in writing: whether by electronic message, public website or other appropriate means.

- No essential employees need letters from their employer that they are permitted to travel to and from work, no one will be pulled over by the police and asked for documentation.

- Businesses considered critical infrastructure can designate their suppliers and others needed to supply goods and materials for sale, clean, etc.

- For more information see Executive Order 2020-21.

- Restaurants and bars, theaters, gyms, coffee houses, other places of accommodation

- Business closures were extended through April 13 via E.O. 2020-20

- Also ordered closed are facilities offering non-essential personal care services;

-

- Non-essential personal care services includes but is not limited to: hair, nail, tanning, massage, traditional spa, tattoo, body art, and piercing services, and similar personal care services that require individuals to be within six feet of each other.

- This does not include services necessary for medical treatment as determined by a licensed medical provider.

-

- See Executive Order 2020-20 for more information and FAQs from the state.

- Executive Order 2020-20 replaces Executive Order 2020-09.

- SNAP

- USDA and FNS issued guidance to states on 3/21/20 on adding emergency SNAP allotments (supplements) to families’ food assistance cards.

- Recently approved federal legislation allows states to request and provide additional monthly benefits or new monthly benefits for families with children who would normally receive free or reduced price school meals but are unable to attend their school due to closure related to COVID-19.

- State Agencies may submit plans for schools closed for at least 5 consecutive days during a public health emergency designation during which the school would otherwise be in session.

- USDA and FNS issued guidance to states on 3/21/20 on adding emergency SNAP allotments (supplements) to families’ food assistance cards.

- WIC:

- Recent federal legislation allows states to waive the minimum stocking requirements set forth in 42 CFR 246.12(g)(3)(i). The approval to waive the minimum stocking requirements will include a waiver of onsite pre-authorization visits to check minimum stocking requirements.

- No action has been taken yet on specific substitution allowances (of smaller sizes to equal the regular size) but language may be included in the next federal COVID-19 response bill slated to be worked on the week of March 23.

- Emergency Paid Sick Leave

- All companies with under 500 employees must provide eligible employees with 80 hours (10 days) of paid sick leave related to coronavirus.

- The law includes a provision to allow the U.S. Secretary of Labor to exempt employers with fewer than 50 employees from the requirements if it would jeopardize the viability of the business. (No exemption has happened yet.)

- The law is set to take effect within 15 days after it was signed into law. That means it will be effective by April 2 but could be effective earlier than that.

- For detailed information on benefits and employee eligibility requirements see our post on Emergency Paid Sick Leave and FMLA coverage.

- All companies with under 500 employees must provide eligible employees with 80 hours (10 days) of paid sick leave related to coronavirus.

- Emergency Family Medical Leave Act (FMLA) coverage

- All companies with under 500 employees must provide eligible employees with 12 total weeks of leave (first two weeks are unpaid, next 10 weeks are paid) emergency family medical leave. Employees are eligible if they are unable to work (or telework) because they have a son or daughter under 18 who requires care due to school closures or childcare-related closures (paid childcare facilities) due to coronavirus.

- The law includes a provision to allow the U.S. Secretary of Labor to exempt employers with fewer than 50 employees from the requirements if it would jeopardize the viability of the business. (No exemption has happened yet.)

- For detailed information on benefits and employee eligibility requirements see our post on Emergency Paid Sick Leave and FMLA coverage.

- All companies with under 500 employees must provide eligible employees with 12 total weeks of leave (first two weeks are unpaid, next 10 weeks are paid) emergency family medical leave. Employees are eligible if they are unable to work (or telework) because they have a son or daughter under 18 who requires care due to school closures or childcare-related closures (paid childcare facilities) due to coronavirus.

- Unemployment

- The state is urging employers to put employees on temporary leave, if possible. This will ensure that workers do not have to job search while receiving benefits.

- If you place workers on temporary leave, advise the worker that you expect to have work available within 120-days as opposed to termination.

- There is no additional cost to employers, employees remain eligible for UI benefits through the state, and employees may remain eligible for potential federal assistance.

- The state is urging employers to put employees on temporary leave, if possible. This will ensure that workers do not have to job search while receiving benefits.

- Price gouging

- Retailers may not sell a product at a price that is more than 20 percent higher than what was charged prior to March 9, 2020.

- Exception for increases directly related to product acquisition cost or if the product was discounted/on sale as of March 9, 2020. (updated 3/20/20)

- See Executive Order 2020-18 for more information.

- E.O. 2020-18 replaces E.O. 2020-8.

- Retailers may not sell a product at a price that is more than 20 percent higher than what was charged prior to March 9, 2020.

- Michigan Employers FAQs on Coronavirus and Your Employees (information provided by law firm Foster Swift)

- Restaurants and bars, theaters, gyms, coffee houses, other places of accommodation

- FAQs on Executive Order 2020-09

- Clarification that all seating areas in grocery stores, delis, coffee shops, etc. must be closed in addition to restaurant and bar dining/serving areas. They may remain open for take-out only.

- Unemployment Work Share program

- See FAQs from the state on Executive Order 2020-10.

- Small Business Administration disaster relief assistance loans

- Michigan was granted a formal Economic Injury Disaster Loan Declaration from SBA on March 19.

- Economic assistance for small businesses

- On March 19, the Michigan Strategic Fund approved up to $20 million in support funds (grants and loans) for small businesses.

- $10 million to local or nonprofit economic development organizations throughout the state to provide grants up to $10,000 each to support certain small businesses (fewer than 50 employees) that have realized a significant financial hardship as a result of the COVID-19 virus. Grants will be to be distributed by nonprofit economic development organizations throughout the state.

- $10 million in loans ranging from $50,000-$200,000 to small businesses (fewer than 100 employees) to be distributed by Community Development Financial Institutions (banks, credit unions, loan funds, microloan funds, or venture capital providers).

- Companies eligible for either the grants or loans, must:

- Be in an industry closed via Executive Order, or can demonstrate it is otherwise affected by the COVID-19 outbreak;

- Needs working capital to support payroll expenses, rent, mortgage payments, utility expenses, or other similar expenses that occur in the ordinary course of business; and

- The company is able to demonstrate an income loss as a result of the EO, or the COVID-19 outbreak.

- The legislature:

- The House and Senate will meet at 10 a.m. on March 25, April 1, April 7 and April 15, according to new schedules issued on March 18.

- State and local board, agencies and commission meetings

- In-person state board and commission meetings are canceled through March 31. The state is working on setting up virtual meetings.

- Workers’ Compensation in-person hearings are suspended until April 20.

- Executive Order 2020-15 temporarily changed the Open Meetings Act to allow public bodies to conduct meetings electronically through April 15.

- Public bodies subject to the Open Meetings Act include boards, commissions, committees, subcommittees, authorities, councils, and nonprofit boards.

- These entities can use telephone- or video-conferencing methods to continue meeting and conducting business but must ensure meaningful access and participation by members of the public body and the general public.

- See Executive Order 2020-15 for more information.

- U.S.-Canada border closed to nonessential travel

- An agreement reached between U.S. and Canadian governments on March 18 closed the entire Canadian border to non-essential travel.

- The Detroit-Windsor Tunnel announced it would soon close to “nonessential personnel, including regular travelers,” but the closure time was not announced.

- The Ambassador Bridge in Detroit, the Blue Water Bridge in Port Huron and the International Bridge in Sault Ste Marie will remain open.

- Bridges will stay open for essential traffic and commercial goods.

- Mackinac Bridge Authority

- The Mackinac Bridge Authority will not accept cash transactions beginning March 21.

COVID-19 resources:

- State of Michigan gov/Coronavirus

- State of Michigan: Interim Recommendations to Mitigate the Spread of COVID-19 (March 11, 2020)

- CDC: cdc.gov/Coronavirus

- National Retail Federation

- The Food Industry Association (FMI)

State closings and prohibitions on gatherings:

- Stay Home Order extended through May 15, some regulations relaxed (updated 5/3/20)

- Executive Order 2020-70 extends and replaces Gov. Whitmer’s previous Stay Home, Stay Safe order (E.O. 2020-42 and E.O. 2020-59) that was set to expire on April 30. The new order extends through 11:59 p.m. on May 15. This order must be construed broadly to prohibit in-person work that is not necessary to sustain or protect life.

- The new order specifically allows previously closed retailers to now offer retail-to-go remote sales of all products if it’s done via delivery or curbside.

- The new order also reopens previously closed sections of the store including garden centers, paint, furniture and flooring sections.

- Garden centers, nurseries, landscapers, lawncare, moving, storage, bicycle maintenance and repair work, maintenance and pest control operations may reopen or start operating under the order. They must limit in-person interaction with customers and provide protective gear to employees such as gloves, goggles, face shields, and face masks as appropriate for the activity being performed. Garden centers and nurseries must ensure proper 6-foot social distancing can occur and bar any gathering points that would otherwise occur.

- All businesses that have employees performing in-person work to provide employees with at least cloth face coverings by 11:59 p.m. on Sunday, April 26.

- Attorney General Nessel subsequently issued a statement asking law enforcement officers to be lenient in issuing misdemeanor charges against businesses who do not immediately comply if they have made a good faith effort to acquire masks for their workers.

- It also requires anyone able to medically tolerate a face covering to wear one covering their nose and mouth (such as a homemade mask, scarf, bandana, or handkerchief) when in any enclosed public space.

- Stores are not expected to enforce this requirement and the governor stated no citations would be issued to individuals for noncompliance.

- Stores may refuse to serve anyone or allow them to enter if the person is not wearing a face covering but should be conscious of the medical exceptions and potential lawsuits if they do not accommodate those with medical conditions.

- Open businesses must also develop a COVID-19 preparedness and response plan consistent with recommendations in Guidance on Preparing Workplaces for COVID-19, developed by the Occupational Health and Safety Administration and available here. Such plan must be available at company headquarters or the worksite.

- Stores selling groceries, medical supplies (pharmacies), fuel, pet supplies, auto supplies, appliances, hardware items and home maintenance products must continue following the previously required capacity limits, social distancing markers, and requirements to maintain lines outside the store.

- Capacity limits:

- Stores under 50,000 square feet of customer space: 25% of fire marshal occupancy limits including employees in the total count (including employees).

- Stores over 50,000 square feet of customer space: 4 customers per 1,000 square feet of floor space (does not include employees).

- Requires all stores to implement lines with markers outside the store ensuring social distancing and encourages adding alternate methods to notify seniors and disabled individuals when they can enter (via a text or call feature).

- The order also specifically allows the DHHS director to issue an emergency order varying the capacity limits for small and large stores.

- Food establishments and pharmacies must meet new requirements under E.O. 2020-60 (updated to E.O. 2020-71)

- All food-selling establishments (grocery stores, convenience stores, and restaurants) and pharmacies must follow additional cleaning, mitigation and employee screening efforts. The order took effect April 26 and runs through May 22. The full list of requirements is here.

- Capacity limits:

- The administration recommends that businesses read the order carefully and consult with their legal counsel on whether or not they are permitted to remain open and what functions they may continue. (added 3/24/20)

- While we cannot provide legal advice on whether your specific business can stay open, we can steer you in the right direction. The Governor listed the types of qualifying sectors in her Executive Order and also referenced guidance from the Director of U.S. Cybersecurity and Infrastructure Security Agency. Both of those documents are linked below and should help you in making your determination. (added 3/24/20)

- State guidance for employers on what is and isn’t considered critical infrastructure. (added 3/29/20)

- Notifications:

- Businesses considered critical infrastructure can designate their suppliers and others needed to supply goods and materials for sale, clean, etc.

- Businesses should send those designated entities a letter telling them they are critical to your business and able to operate.

- Employees must be notified if they are considered essential. That can be done verbally through March 31, and then must bet put in writing: whether by electronic message, public website or other appropriate means. (added 3/24/20)

- No essential employees need letters from their employer that they are permitted to travel to and from work, no one will be pulled over by the police and asked for documentation.

- Businesses considered critical infrastructure can designate their suppliers and others needed to supply goods and materials for sale, clean, etc.

- For more information see Executive Order 2020-70. See the state’s frequently updating FAQs for more guidance.

- Guidance from the Director of U.S. Cybersecurity and Infrastructure Security Agency (added 3/24/20)

- Please note: Michigan did NOT adopt updated CISA lists #2 or #3 and only follows the original March 19 critical infrastructure list linked above.

- Schools:

- On March 12, Gov. Whitmer ordered all schools in Michigan to close from March 16-April 5.

- Schools will remain closed for in-person instruction through the end of the school year (June 2020). Schools were required to implement virtual or packet-based learning for students. These plans must be approved by the state.

- Public universities:

- On March 11, most of the state’s public universities moved to online-only instruction and asked students to return to their permanent place of residence, if possible.

- State and local board, agencies and commission meetings and courts (updated 5/3/20)

- Workers’ Compensation in-person hearings are suspended until May 11 at 11:59. See Executive Order 2020-45 https://www.michigan.gov/whitmer/0,9309,7-387-90499_90705-525891–,00.html for more information.

- Executive Order 2020-48 temporarily changed the Open Meetings Act to allow public bodies to conduct meetings electronically through May 12.

- Public bodies subject to the Open Meetings Act include boards, commissions, committees, subcommittees, authorities, councils, and nonprofit boards.

- These entities can use telephone- or video-conferencing methods to continue meeting and conducting business but must ensure meaningful access and participation by members of the public body and the general public.

- See Executive Order 2020-48 for more information.

- Courts

- May adjourn matters where defendant not in custody

- Utilize video conferencing

- Waive some fees and strict adherence to rules or procedural requirements

- The legislature: (updated 5/3/20)

- The House and Senate met at 10 a.m. on March 25, April 7 and April 24.

- Legislators came into town specifically to approve a resolution on April 7 extending Gov. Whitmer’s powers to issue emergency orders through April 30.

- The House and Senate revised its schedule to meet at 10 a.m. on April 28, April 29 and April 30 and will continue meeting regularly based on its normal Tuesday-Thursday schedule going forward.

- A special session of the House and Senate was called on April 24. A COVID-19 task force was created to “examine the status and efficacy of governmental actions” in response to the COVID-19 pandemic and then issue a report on its findings to the Legislature, which can take any actions it deems necessary. The committee will have subpoena power to require any state department, board, institution, or agency to produce any documents they request.

- House Committee members include Rep. Matt HALL (R-Emmett Twp.) chair, Rep. Julie CALLEY (R-Portland), Rep. Jack O’MALLEY (R-Lake Ann), Rep. Vanessa GUERRA (D-Saginaw) and Rep. Tyrone CARTER (D-Detroit).

- Senate committee members include Aric NESBITT (R-Lawton) chair, Sen. Kim LaSATA (R-Bainbridge Twp.), Sen. Wayne SCHMIDT (R-Traverse City), Sen. Curtis HERTEL (D-East Lansing) and Sen. Adam HOLLIER (D-Detroit).

- Legislators came into town specifically to approve a resolution on April 7 extending Gov. Whitmer’s powers to issue emergency orders through April 30.

- The legislature has asked all staff to work from home on non-session days and non-essential staff to work from home until further notice. All non-essential out-of-state work travel by Senate and House employees have been scrapped.

- The legislature is specifically exempt from the prohibition on large gatherings.

- The House and Senate met at 10 a.m. on March 25, April 7 and April 24.

- State Capitol and related public gatherings:

- All state Capitol public tours, receptions and legislative public gatherings are canceled until further notice.

- MRA’s April 28 legislative reception was canceled and will return next year.

- No gatherings or assemblies (updated 5/3/20)

- All individuals currently living within the State of Michigan are ordered to stay at home or at their place of residence.

- Subject to the same exceptions, all public and private gatherings of any number of people occurring among persons not part of a single household are prohibited.

- The new order requires individuals to limit, to the maximum extent possible, the number of household members who leave home for errands.

- Exceptions are to attend a funeral or addiction recovery meeting provided that no more than 10 people are in attendance.

- See Executive Order 2020-70 for more information.

- Restaurants and bars, theaters, gyms, coffee houses, other places of accommodation (updated 3/22/20)

- The following businesses were ordered to close as of 3:00 pm on March 16 and continuing through May 28. (updated 5/3/20 via E.O. 2020-69)

- Restaurants, food courts, cafes, coffeehouses, and other places of public accommodation offering food or beverage for on-premises consumption;

- This includes all seating areas in grocery stores, delis, coffee shops, etc. (added 3/19/20)

- Restaurants and bars may continue providing to-go orders or drive through orders.

- Restaurants can have only 5 members of the public inside at a time and they must remain 6 feet apart.

- Bars, taverns, brew pubs, breweries, microbreweries, distilleries, wineries, tasting rooms, special licensees, clubs, and other places of public accommodation offering alcoholic beverages for on-premises consumption;

- Hookah bars, cigar bars, and vaping lounges offering their products for on premises consumption;

- Theaters, cinemas, and indoor and outdoor performance venues;

- Libraries and museums;

- Gymnasiums, fitness centers, recreation centers, indoor sports facilities, indoor exercise facilities, exercise studios, and facilities offering non-essential personal care services;

- Non-essential personal care services includes but is not limited to: hair, nail, tanning, massage, traditional spa, tattoo, body art, and piercing services, and similar personal care services that require individuals to be within six feet of each other.

- This does not include services necessary for medical treatment as determined by a licensed medical provider.

- Casinos licensed by the Michigan Gaming Control Board, racetracks licensed by the Michigan Gaming Control Board, and Millionaire Parties licensed by the Michigan Gaming Control Board;

- Places of public amusement not otherwise listed above including but not limited to: amusement parks, arcades, bingo halls, bowling alleys, indoor climbing facilities, skating rinks, trampoline parks, and other similar recreational or entertainment facilities.

- The restrictions do not apply to:

- Office buildings, grocery stores, markets, food pantries, pharmacies, drug stores, stores selling consumer goods, providers of medical equipment and supplies and health care facilities.

- No retailers are ordered to close but should keep customers 6 feet apart.

- Restaurants, food courts, cafes, coffeehouses, and other places of public accommodation offering food or beverage for on-premises consumption;

- The state’s Department of Natural Resources closed shooting ranges on March 18. (added 3/19/20)

- See Executive Order 2020-69 for more information and FAQs from the state. (FAQs link added 3/19/20)

- Executive Order 2020-69 replaces E.O. 2020-20, which replaced E.O. 2020-9. (updated 5/3/20)

- The following businesses were ordered to close as of 3:00 pm on March 16 and continuing through May 28. (updated 5/3/20 via E.O. 2020-69)

- Limits on visits to hospitals, nursing homes, and juvenile justice facilities

- Prohibit visitors that are not necessary for the provision of medical care

- Allow parents, foster parents, or guardians of individuals under 21.

- See Executive Order 2020-37 for more information (E.O. 2020-37 replaces E.O. 2020-7).

- U.S.-Canada border closed to nonessential travel (added 3/19/20)

- An agreement reached between U.S. and Canadian governments on March 18 closed the entire Canadian border to non-essential travel.

- The Detroit-Windsor Tunnel announced it would soon close to “nonessential personnel, including regular travelers,” but the closure time was not announced.

- The Ambassador Bridge in Detroit, the Blue Water Bridge in Port Huron and the International Bridge in Sault Ste Marie will remain open.

- Bridges will stay open for essential traffic and commercial goods.

- Mackinac Bridge Authority (added 3/19/20)

- The Mackinac Bridge Authority will not accept cash transactions beginning March 21.

Economic relief for impacted businesses

- Loans, loan guarantees and investments under the CARES Act: (added 3/30/20)

- Under the CARES Act signed into law on March 27, the U.S. Treasury Secretary is permitted to make loans, loan guarantees and investments in an amount not to exceed $500 billion.

- The Paycheck Protection Program is intended to promote the retention of employees by providing funds for short term expenses.

- Available to businesses with fewer than 500 employees and in an amount not to exceed 250% of average monthly payroll.

- Loans are eligible for forgiveness to the extent the money is used for payroll, rent, utilities and mortgage interest obligations. Loan repayments can also be deferred for a period of time.

- The eligible loan period is retroactive to February 15, 2020 through June 30, 2020.

- There are certain prohibitions when taking advantage of these loans. These include prohibitions on stock buybacks and dividends, unless there is already an existing agreement or contract in place, and limits on executive compensation during the term of the loan plus a period of time thereafter.

- The loans will be guaranteed by the Small Business Administration and will likely be issued by most FDIC insured banks. Retailers wishing to take advantage of these loans should be in contact with an appropriate lending institution to inquire about the application process.

- For more information view our full post on the Federal CARES Act Includes Key Provisions for Retailers.

- Application information/timelines:

- Small businesses and sole proprietorships could apply as of April 3. Independent contractors and self-employed individuals can apply as April 10.

- The program initially ran out of funds on April 16 and MRA joined other business groups are encouraging Congress to approve more funding for PPP loans.

- On April 24, $300 billion in funds were approved for Small Business Administration loans beyond the original $350 billion funded under the CARES Act. These funds are critical for small businesses that could not participate in the first round of loans. The new application period opened on Monday, April 27.

- On April 26, SBA released new guidance on accessing the PPP in an updated FAQ.

- Helpful resources for applicants and borrowers:

- Small Business Administration disaster relief assistance loans

- SBA’s Economic Injury Disaster Loans offer up to $2 million in assistance for a small business. These loans can provide vital economic support to small businesses to help overcome the temporary loss of revenue they are experiencing.

- Further resources can be found on SBA’s website: SBA.gov/coronavirus and www.SBA.gov/disaster.

- Michigan was granted a formal Economic Injury Disaster Loan Declaration from SBA on March 19. (updated 3/19/20)

- Once granted, small businesses in qualifying areas will be able to access low-interest loans through the SBA.

- In the interim, small businesses that could benefit from SBA loans are encouraged to start collecting the information they’ll need to complete and submit their application. Examples of information needed can be found here. For additional information or to obtain help preparing the loan application in advance of the declaration, please contact the Michigan SBA offices in Detroit or Grand Rapids.

- SBA’s Economic Injury Disaster Loans offer up to $2 million in assistance for a small business. These loans can provide vital economic support to small businesses to help overcome the temporary loss of revenue they are experiencing.

- Economic assistance for small businesses (added 3/19/20)

- On March 19, the Michigan Strategic Fund approved up to $20 million in support funds (grants and loans) for small businesses.

- $10 million to local or nonprofit economic development organizations throughout the state to provide grants up to $10,000 each to support certain small businesses (fewer than 50 employees) that have realized a significant financial hardship as a result of the COVID-19 virus. Grants will be to be distributed by nonprofit economic development organizations throughout the state.

- $10 million in loans ranging from $50,000-$200,000 to small businesses (fewer than 100 employees) to be distributed by Community Development Financial Institutions (banks, credit unions, loan funds, microloan funds, or venture capital providers).

- Companies eligible for either the grants or loans, must:

- Be in an industry closed via Executive Order, or can demonstrate it is otherwise affected by the COVID-19 outbreak;

- Needs working capital to support payroll expenses, rent, mortgage payments, utility expenses, or other similar expenses that occur in the ordinary course of business; and

- The company is able to demonstrate an income loss as a result of the EO, or the COVID-19 outbreak.

- Oakland County Stabilization Fund for Small Businesses (added 3/29/20)

- Small business owners with 100 or less employees in Oakland County can apply for either grant or loan funding.

- To be eligible for either the grant or loan, the business must have experienced significant financial hardship as a result of the COVID-19 outbreak or related state executive orders.

- Small businesses can view the eligibility criteria on Oakland County’s website.

- Business tax relief under the CARES Act: (added 3/30/20)

- Employers may now defer 50% of 2020 employer payroll taxes until December 31, 2021, with the remaining 50% due December 31, 2022.

- 50% refundable payroll tax credit for employers who had their business fully or partially suspended.

- Net operating losses from 2018, 2019 and 2020 can be carried back to the previous five years to offset taxable income. This will generate an immediate rebate on taxes already paid.

- Businesses will now be able to deduct 50% of interest expenses from 2019 and 2020 (up from the current 30%).

- Remodeling projects done by retailers and restaurants in 2018 and 2019 can be depreciated more quickly on an amended tax return. Those overpayments will be refunded because the CARES Act corrected a previous tax reform glitch that impacted the depreciation period for improvements.

- For more information view our full post on the Federal CARES Act Includes Key Provisions for Retailers.

- IRS tax filing delay (updated 3/29/20)

- U.S. Treasury Secretary Steven Mnuchin announced on March 17 that the IRS will delay collection of tax payments 90 days for individual taxpayers with up to $1 million in payments and businesses with up to $10 million in payments.

- On March 21 the IRS extended the filing and payment deadline to all taxpayers from April 15 to July 15.

- State of Michigan tax filing delay (added 3/29/20)

- The State of Michigan extended tax filing deadlines from April 15 to July 15 to match the revised federal deadline.

- For more information see Executive Order 2020-26.

- Treasury Issues Guidance about new tax deadlines for individuals and businesses (added 5/3/20)

- State Sales, Use and Withholding (SUW) tax payment delay

- On March 18, the Michigan Department of Treasury announced small businesses scheduled to make their monthly sales, use and withholding tax payments on March 20 can postpone filing and payment requirements until April 20.

- The state Treasury Department will waive all penalties and interest for 30 days.

- The waiver is not available for accelerated sales, use or withholding tax filers.

- Businesses with questions should call the Treasury Business Tax Call Center at 517-636-6925.

- On March 18, the Michigan Department of Treasury announced small businesses scheduled to make their monthly sales, use and withholding tax payments on March 20 can postpone filing and payment requirements until April 20.

- Michigan Economic Development Corporation programs:

- The call center stands ready to support businesses looking for assistance through other available state programs. For more information, visit MEDC’s website: michiganbusiness.org or call 888.522.0103.

- The Michigan Small Business Development Center can also provide resources for small businesses impacted by COVID-19. Visit their website https://sbdcmichigan.org/small-business-covid19/ for additional information.

Unemployment benefits, Work Share Program, Emergency Paid Sick Leave and Emergency FMLA coverage

- Current employees

- Emergency Paid Sick Leave (added 3/20/20)

- All companies with under 500 employees must provide eligible employees with 80 hours (10 days) of paid sick leave related to coronavirus.

- The law includes a provision to allow the U.S. Secretary of Labor to exempt employers with fewer than 50 employees from the requirements if it would jeopardize the viability of the business. (No exemption has happened yet.)

- It took effect on April 1. (updated 3/29/20)

- Employers are only eligible for tax credits for payments to employees beginning on April 1.

- For detailed information on benefits and employee eligibility requirements see our post on Emergency Paid Sick Leave and FMLA coverage.

- See additional information from the Department of Labor: Families First Coronavirus Response Act FAQs. (added 3/29/20)

- The act also includes a new posting requirement. The poster can be found here: Employee Rights Paid Sick Leave and Expanded FMLA under the Families First Coronavirus Response Act. (added 3/29/20)

- Employers with employees teleworking or working from home are encouraged to post the notice on their website and/or send it to employees via email.

- All companies with under 500 employees must provide eligible employees with 80 hours (10 days) of paid sick leave related to coronavirus.

- Emergency Family Medical Leave Act (FMLA) coverage (added 3/20/20)

- All companies with under 500 employees must provide eligible employees with 12 total weeks of leave (first two weeks are unpaid, next 10 weeks are paid) emergency family medical leave. Employees are eligible if they are unable to work (or telework) because they have a son or daughter under 18 who requires care due to school closures or childcare-related closures (paid childcare facilities) due to coronavirus.

- The law includes a provision to allow the U.S. Secretary of Labor to exempt employers with fewer than 50 employees from the requirements if it would jeopardize the viability of the business. (No exemption has happened yet.)

- It will be effective on April 1. (updated 3/29/20)

- Employers are only eligible for tax credits for payments to employees beginning on April 1.

- For detailed information on benefits and employee eligibility requirements see our post on Emergency Paid Sick Leave and FMLA coverage.

- See additional information from the Department of Labor: Families First Coronavirus Response Act FAQs. (added 3/29/20)

- The act also includes a new posting requirement. The poster can be found here: Employee Rights Paid Sick Leave and Expanded FMLA under the Families First Coronavirus Response Act. (added 3/29/20)

- Employers with employees teleworking or working from home are encouraged to post the notice on their website and/or send it to employees via email.

- All companies with under 500 employees must provide eligible employees with 12 total weeks of leave (first two weeks are unpaid, next 10 weeks are paid) emergency family medical leave. Employees are eligible if they are unable to work (or telework) because they have a son or daughter under 18 who requires care due to school closures or childcare-related closures (paid childcare facilities) due to coronavirus.

- Emergency Paid Sick Leave (added 3/20/20)

- Underemployed or unemployed workers

- Work Share program

- The state expanded its Work Share Program for those filing during the declared states of emergency and disaster to prevent layoffs.

- Work share allows an employer to have employees work reduced hours and receive a portion of weekly unemployment benefits.

- Benefits are based on the percentage of reduced hours of work and pay and must result in a reduction in wages.

- Executive Order 2020-57 gives more flexibility on the Work Share program, allowing the state to approve an employer’s participation in the program upon application, regardless of whether they meet the statutory requirements. This change will allow more employers to participate in the Work Share program on a temporary basis.

- Specifically, it allows employers more flexibility on the number of hours that can be reduced. Previously, the Work Share program allowed an hourly reduction between 15 and 45 percent. Executive Order 2020-57 now allows a reduction between 10 and 60 percent.

- Executive Order 2020-57 gives more flexibility on the Work Share program, allowing the state to approve an employer’s participation in the program upon application, regardless of whether they meet the statutory requirements. This change will allow more employers to participate in the Work Share program on a temporary basis.

- Employers are encouraged to implement the program that permits employers to maintain operational productivity during declines in regular business activity instead of laying off workers.

- More information about Michigan’s Work Share Program can be found here and specific guidance related to COVID-19 is available here. (COVID-19 guidance added 3/29/20)

- See Executive Order 2020-10 for more information and FAQs from the state. (FAQs link added 3/19/20)

- Unemployment benefits: (updated 5/3/20)

- On April 22, the Governor signed Executive Order 2020-57 (replaces E.O. 2020-24).

- State benefits are retroactive to March 16, 2020 and have been extended during the declared states of emergency and disaster to cover:

- Workers who have an unanticipated family care responsibility, like childcare due to school closures or carrying for a loved one who becomes ill.

- Workers who are sick, quarantined or immunocompromised and do not have access to paid leave time or are laid off.

- First responders in the public health community who become ill or are quarantined.

- New or additional claims for unemployment benefits filed within 28 days of the last day the claimant worked will be considered to have been filed on time, and a continued claim filed within 28 days of the last day of the period for which the claimants is instructed to report and has continued to report in a claim series to be considered to have been filed on time.

- State benefits are retroactive to March 16, 2020 and have been extended during the declared states of emergency and disaster to cover:

- Additional federal benefits will be in effect until Dec. 31, 2020 to help workers impacted by COVID-19. (added 3/29/20)

- Benefit payments are extended from 26 weeks to 39 weeks.

- Supplements standard payments by $600.00 per week.

- It also provides payments to those not traditionally eligible for unemployment benefits, including self-employed individuals, who are unable to work as a direct result of the coronavirus public health emergency.

- Self-employed workers can file for unemployment as of Monday, April 13

- The Michigan Unemployment is now accepting applications from self-employed workers. Newly eligible for federal Pandemic Unemployment Assistance (PUA) include self-employed workers, gig workers, 1099-independent contractors and low-wage workers affected by COVID-19.

- These workers will receive their state benefit amount (paid with federal funds) and the $600 federal payment as early as April 20.

- The UIA will be accepting applications back-dated to reflect the date on which the claimant was laid-off due to COVID-19, beyond the previously established 28-day period ($600 federal payment is only retroactive back to March 28).

- How to receive these benefits:

- Workers who have previously applied for unemployment benefits and have been denied should login to their MiWAM account to complete the next steps (check your email for details from UIA) for PUA federal benefits. They should not file a new claim, as that may delay the time it takes to get their benefits.

- All newly eligible workers will need to provide proof of income to receive the maximum amount they are entitled. This could include W-2s, 1099 tax forms, and pay stubs. New filers should begin receiving federal benefits as early as April 20 after their bi-weekly certification.

- Individuals on paid sick leave or other paid leave – and those who have the ability to telework with pay – are not eligible for PUA.

- Applicants are encouraged to file online at gov/UIA. Workers need to use the UIA’s daily filing schedule based on their last names (see below).

- Last names beginning with letters A-L: file claims on Mondays, Wednesday, Fridays.

- Last names beginning with letters M-Z: file claims on Sundays, Tuesdays, or Thursdays.

- Saturdays will be available for anyone to accommodate those who could not file during their allotted window.

- The state is urging employers to put employees on temporary leave, if possible. This will ensure that workers do not have to job search while receiving benefits. (added 3/20/20)

- If you place workers on temporary leave, advise the worker that you expect to have work available within 120-days as opposed to termination.

- There is no additional cost to employers, employees remain eligible for UI benefits through the state, and employees may remain eligible for potential federal assistance.

- Temporary leave unemployment form: a notice employers should provide to employees related to temporary layoffs that will be needed to file for unemployment benefits is available here. (added 3/29/20)

- Benefits for unemployed workers increased:

- Benefits increased from 20 to 26 weeks.

- The application eligibility period increased from 14 to 28 days.

- The normal in-person registration and work search requirements are suspended.

- Businesses won’t be charged if an employee becomes unemployed or is placed on temporary leave. It will instead be charged to the Unemployment Insurance Agency’s non-chargeable account. (added 3/29/20)

- Effective March 25, 2020 at 11:59 pm, the benefits conferred on employers by this section are not available to employers determined to have misclassified workers.

- The state urges unemployed workers to file for benefits online at Michigan.gov/UIA or by calling 1-866-500-0017 rather than going into an office.

- A factsheet on how to apply for benefits can also be found here.

- Michigan Works! resources can be found at MichiganWorks.org or by calling 1-800-285-WORKS.

- See Executive Order 2020-57 (replaces E.O. 2020-24) for more information and FAQs from the state.

- E.O. 2020-57 is in effect during the declared states of emergency and disaster.

- On April 22, the Governor signed Executive Order 2020-57 (replaces E.O. 2020-24).

- Work Share program

Relaxed government regulations

- Motor carriers

- Seasonal weight restrictions lifted in Michigan

- Michigan Department of Transportation announced on March 15 that it will exempt from seasonal weight restrictions motor carriers and drivers providing direct assistance in support of relief efforts.

- On March 16, the state formally lifted all state and local seasonal weight restrictions and restrictions on the noise and timing of loading and deliveries in support of relief efforts that provide medical supplies, food, sanitization and prevention supplies.

- See Executive Order 2020-44 (replaces E.O. 2020-12) for more information on the suspension of restrictions until May 11. (updated 5/3/20)

- See Executive Order 2020-44 (replaces E.O. 2020-12) for more information on the suspension of restrictions until May 11. (updated 5/3/20)

- Federal government suspends hours of service requirements for drivers:

- US DOT issued an emergency declaration that suspends Hours of Service requirements for drivers providing direct assistance in support of emergency relief. The emergency declaration specifically applies to the transportation of:

- Medical supplies and equipment related to the testing, diagnosis and treatment of COVID-19;

- Supplies and equipment necessary for community safety, sanitation, and prevention of community transmission of COVID-10 such as masks, gloves, hand sanitizer, soap and disinfectants;

- Food for emergency restocking of stores;

- Equipment supplies and persons necessary to establish and manage temporary housing, quarantine and isolation facilities related to COVID-19;

- Persons designated by Federal, State or local authorities for medical, isolation or quarantine purposes; and

- Persons necessary to provide other medical or emergency services, the supply of which may be affected by the COVID-19 response.

- US DOT issued an emergency declaration that suspends Hours of Service requirements for drivers providing direct assistance in support of emergency relief. The emergency declaration specifically applies to the transportation of:

- CDL and CLP expiration dates extended

- The Federal government (FMCSA) has waived the expiration date for CDL (Commercial Drivers License) and CLP (Commercial Learners Permit) holders until June 30. (added 3/24/20)

- Many drivers have experienced issues with obtaining access to state licensing offices and to medical examiners to obtain the required physical.

- The waiver extends the date of expiration – until June 30 – of applicable CDLs, CLPs, and non-CDL licenses of commercial drivers, as well as medical certificates that would otherwise expire between March 1 and June 30.

- The waiver can be found here.

- Seasonal weight restrictions lifted in Michigan

- Youth employment standards

- The state confirmed on March 15 that youth employees (ages 14-17) can work additional hours (up to 48) while schools are closed.

- If schools are issuing remote work, employers should ensure students are not exceeding 48 combined hours of schooling and work.

- Bottle returns under Michigan’s bottle deposit law considered nonessential (updated 3/24/20)

- The governor’s office clarified that they do not consider bottle and can returns under the state’s bottle deposit law an essential service under Executive Order 2020-21 (subsequently replaced by E.O. 2020-59 and E.O. 2o2o-70).

- Grocers can temporarily stop accepting bottle and can returns as of March 24 – May 15.

- The state has indicated this service is not essential in FAQs on E.O. 2020-59.

- MRA requested the state follow Connecticut, Iowa, Maine, Massachusetts, Oregon and Vermont’s lead and suspend its enforcement of the bottle deposit law to allow workers to focus on providing essential services and avoid contamination from surfaces that may be harboring the coronavirus.

- Eight of the 11 states with a bottle deposit law have suspended takeback of containers.

- Stay tuned: MRA is working with the state and members on what it will take to bring this service back safely. We do not expect it to be deemed essential anytime soon and have shared the many concerns and ideas members have to restart takeback safely.