Whitmer’s first budget is a tax and shift plan

On Tuesday, Gov. Whitmer released her first state budget, a $60 billion plan that adds nearly $4 billion in new funding. The budget attempts to address some of her key campaign promises to fix the roads, increase education funding and focus on water quality issues. It also shifts funding sources in a way that the administration believes is more straightforward (e.g. education dollars going only to K-12 schools). To fund her priorities there are two proposed tax increases that may impact retailers: a 45-cent gas tax increase and an increase in the income tax rate for businesses filing as S-corps and LLCs.

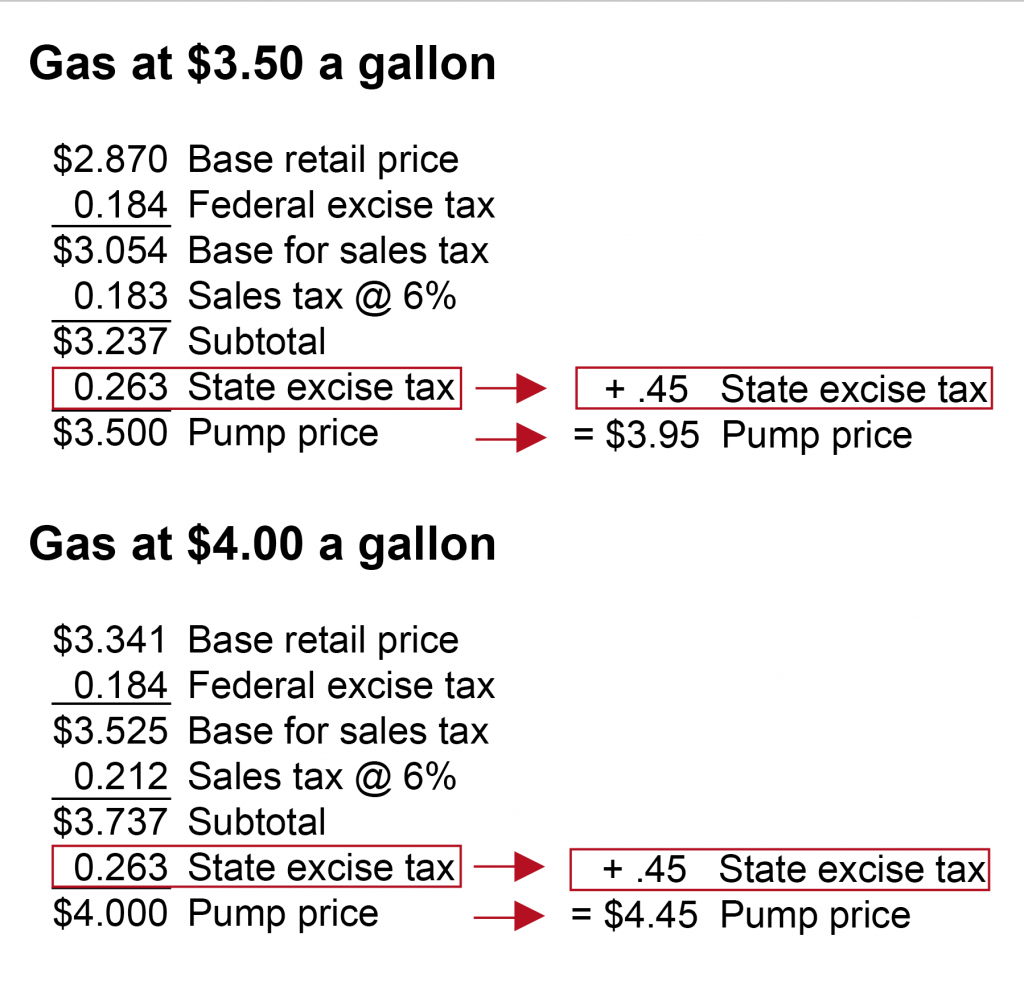

First, the governor’s budget includes a substantially higher gas tax – an increase of 45 cents, phased in 15 cents at a time over a year and a half time span. These new funds would generate $2.5 billion and be used to fund critical road and infrastructure repairs each year. It’s important to note that state taxes aren’t the only tax Michiganders pay at the pump. Michigan residents also pay an 18.4 cent per gallon federal tax as well as the state’s six percent sales tax. The sales tax is levied on top of the retail price of gas and the federal 18.4 cent per gallon tax but not on the state’s 26.3 cent per gallon gas tax (see examples of the price breakdown to the left). Also important is that the new funds would be subject to a different distribution formula, less regionally-focused and more priority-based, than the current 26.3 cent per gallon Michigan fuel tax revenue.

Second, the budget attempts to tax all businesses, including pass through businesses like S-Corporations and LLCs the same rate, at six percent. This new revenue would be used to offset the removal of the “pension tax” on public pensions. S-corporations and LLCs are currently taxed through the income reported on an individual’s income tax at the 4.25 percent Michigan Income Tax. An increase to six percent would be a 41 percent increase in the tax rate on mostly the small businesses who utilize the S-corporation and LLC structures.

While it doesn’t sound like a huge increase, this would be the fourth tax structure for small businesses to comply with in the last 10 years (Michigan Business Tax/MBT, Single Business Tax/SBT, Corporate Income Tax/CIT). That’s a lot of uncertainty and change for employers to handle on top of the increases in wage and benefits imposed by the state and required to retain and attract talent.

Both of these proposals and the entire budget were met with skepticism from the legislature which now will get to work preparing its own budget. Ultimately, expect a lot of compromise in these budget areas on both sides and remember that the governor shared some alternatives for raising the $2.5 billion needed for roads that may be less attractive to businesses and residents. These alternatives include a 7.4 percent sales tax rate (an increase of 1.4 percentage points) or a 19 percent personal income tax rate.

Legislature asks Supreme Court to address min. wage and paid leave changes

Following a state senator’s request for an attorney general opinion, the Michigan legislature passed resolutions HR 25 and SR 16. These resolutions formally asked the Michigan Supreme Court to weigh in on the legality of adopting then amending initiated laws raising the minimum wage and creating medical leave benefits. The legislature took this action since it was likely this question would ultimately fall to the courts to make a final determination. With the legislation slated to take effect in late March (March 29) employers need certainty on what new regulations they will be asked to comply with. Employers should note that laws passed by the legislature are presumed to be constitutional and should assume the changes will go into effect as planned. That said, it would be wise to wait to implement any changes to employee payroll or benefits until March 29 and keep an eye out for updates.

Data breach bill back for discussion

Legislation MRA was active on last year that would change the notification requirements when an entity is the victim of a data breach was reintroduced as HB 4186–4187. MRA testified before the House Financial Services Committee last week on the reasonable amendments retailers need added to the bill in order to be supportive. These amendments include language ensuring third party vendors are held equally accountable by clarifying who must notify and pay for notification if a breach occurs, allowing flexibility in investigation requirements and ensuring only the state can regulate notification requirements. It sounds like changes will be made to the bill but it is uncertain whether those changes will be made in the original committee or in the House Ways and Means Committee. The bill will likely be reported to Ways and Means next week. Next steps: House Financial Services Committee vote. MRA Position: Opposed as introduced, seeking amendments.

Legislation requiring e-prescribing introduced

MRA priority legislation to require all prescriptions be sent electronically to the pharmacy directly by the prescriber was introduced as HB 4217. This legislation will help reduce fraud and errors, improve workflow, and create a better system to track whether a patient has picked up their medication or not as well as potential interactions between various medications. The bill would require prescriptions be sent electronically to pharmacy in most circumstances and includes a hardship waiver for prescribers who cannot reasonably meet the requirements. Other states that have implemented electronic prescription requirements have seen reductions in the amount of fraud particularly related to controlled substance prescriptions like opioids. MRA is meeting with committee members and working to secure a hearing for the bill this spring. Next steps: House Health Policy Committee. MRA Position: Support.

DOL publishes final overtime rule for comment

Last week, the Department of Labor (DOL) published its final proposed overtime rule for comments. The proposed rule can be found here and a fact sheet here. This rule impacts which employees are eligible for overtime and which are exempt. Covered employees must be paid time and a half for any hours worked more than 40 in a workweek. Employees who meet the salary threshold (currently $23,660 or $455/week) and whose job duties also primarily involve executive, administrative or professional duties as defined by the regulations are exempt from overtime pay. [Read more]

MRA members may recall that under the Obama administration the DOL attempted to increase this threshold to $47,476 annually or $913/week but the rule was struck down in court ahead of Pres. Trump taking office. The new proposed changes follow 2004 methodology to update the standard salary level threshold to $35,308 annually or $679/week. There will be a 60-day comment period and the estimated effective date is January 2020. The DOL encourages any interested members of the public to submit comments about the proposed rule electronically at www.regulations.gov, in the rulemaking docket RIN 1235-AA20.

Legislative round-up:

- Alcohol serving hours: HB 4213 would allow a city, township or village to vote to allow sales of alcohol at on premise locations between 2:00-4:00 a.m. Next steps: House Regulatory Reform Committee. MRA Position: Monitoring.

- E-cigarette and vapor product taxes: A bill to tax e-cigarettes and vapor products the same as tobacco products was recently introduced as HB 4188. The bill would add these products into the definition of “smokeless tobacco” beginning Oct. 1, 2019. Next steps: House Regulatory Reform Committee. MRA Position: Under review.

- E-cigarette sales to minors: Legislation to ban sales of e-cigarettes and vapor products to minors was introduced as SB 106. The bill would also increase the penalties for selling to minors from $50 per violation to up to $100 for a first offense, up to $500 for a second offense and up to $2,500 for a third or subsequent offense. The bill would also require liquid nicotine containers be sold in child-resistant packaging and require retailers sell vapor products behind the counter. In addition, minors would be prohibited from purchasing, possessing or using vapor products and would be subject to a $50 civil fine per incident. For a third violation a minor would receive a misdemeanor and be required to participate in a health and risk assessment program. The bill is scheduled for a hearing next week in the Senate. Next steps: Senate Regulatory Reform Committee. MRA Position: Under review.

- Liquid nicotine sales: SB 155 would require liquid nicotine containers be sold in child-resistant packaging and require retailers sell these and other vapor products behind the counter. Violating the packaging requirements is a $50 civil fine and violation of selling the products not behind the counter would be a $500 civil fine. The bill is scheduled for a hearing in the Senate next week. Next steps: Senate Regulatory Reform Committee. MRA Position: Under review.

- Pregnancy and alcohol warning posting requirements: The House is poised to take action on a bill next week that would require retailers selling alcohol to post a warning of the potential problems of drinking alcohol during pregnancy. MRA was successful in getting an amendment added to HB 4112 to add clarity in requiring the new warning be on an existing posting requirement. Next steps: House floor. MRA Position: Neutral.

- Emergency responder work absences: Legislation introduced as SB 162 would allow an employee to be absent from work without fear of punishment if the employee is an emergency responder and the absence was due to an emergency. Next steps: Senate Economic and Small Business Development Committee. MRA Position: Monitoring.

- Homeschool child work permits: HB 4262 would allow a parent or legal guardian to issue a child who is educated at home via homeschool or other similar arrangement a work permit. Next steps: House Education Committee. MRA Position: Neutral.

- Minimum wage increase: Legislation that seeks to restore the timing of the $12 minimum wage increase prescribed by a ballot proposal last year was introduced as HB 4299. It is highly improbable that this bill will move, especially given the committee it was referred to. Next steps: House Government Operations Committee. MRA Position: Oppose.

- Maintenance drug refills: A bill that would ensure patients can receive refills of maintenance medications towards the end of the calendar year was introduced as HB 4293. Similar legislation has been introduced in the past. Next steps: House Health Policy Committee. MRA Position: Monitoring.

- Pseudoephedrine limits: Legislation introduced as SB 170 would lower the current allowable monthly limit of pseudoephedrine an individual can purchase from 9 grams to 7.2 grams as well as setting a 61.2-gram annual limit. Next steps: Senate Health Policy and Human Services Committee. MRA Position: Monitoring.

- 9-1-1 phone systems: Legislation to rescind a rule with an expensive price tag for businesses was introduced as HB 4249. The legislation would rescind a requirement and administrative rules scheduled to go into effect at the end of this year. The rules state any business over 7,000 square feet that has a multiline phone system must install special equipment that can direct 9-1-1 services to the specific location in the building or series of buildings. These systems are costly and the rules were vague on which technology would meet the requirements leaving businesses to guess at compliance and risk penalties if they got it incorrect. MRA will be testifying in support of this legislation to remove this costly requirement and urges members to share examples of what impact this will have on your business. Next steps: House Communications and Technology Committee. MRA Position: Support.

- Drones: Legislation to allow a local unit of government to regulate drone use was introduced as SB 129. This bill is mainly focused on Mackinac Island and the unique challenges drones present to the car-free island that is powered by horse-drawn carriages. Another bill, HB 4300 would prohibit the use of drones for natural resources investigations without the property owner’s consent. Next steps: House Communications and Technology Committee. MRA Position: Support SB 129. Monitoring HB 4300.

- Internet gaming: Reintroductions of legal online gaming legislation were introduced as HB 4307–4312 & SB 186–190. The bills were approved by the legislature last term but vetoed by outgoing Governor Rick Snyder. Next steps: House and Senate Regulatory Reform Committees. MRA Position: Monitoring.

- Tanning ban for minors: HB 4205 would prohibit minors from being able to use tanning facilities. Each violation would carry a $150 fine for the owner of the tanning business. Next steps: House Regulatory Reform Committee. MRA Position: Monitoring.

- Feminine hygiene products: Legislation exempting feminine hygiene products from the state’s sales and use taxes was introduced as HB 4165–4166 and SB 123–124. Next steps: House Tax Policy Committee and Senate Finance Committee. MRA Position: Monitoring.

- Unemployed workers credit: A bill that would create a new tax credit for hiring unemployed workers was introduced as HB 4180. Similar legislation was introduced last year but did not move. Next steps: House Tax Policy Committee. MRA Position: Monitoring.

- Child care credit: Legislation that would create a new tax credit for businesses that offer child care to workers was introduced as HB 4182. Similar legislation was introduced last year but did not move. Next steps: House Tax Policy Committee. MRA Position: Monitoring.

- PPT exemption threshold increase: Legislation to increase the exemption threshold from the Personal Property Tax filings for small businesses from $80,000 in commercial personal property to $100,000 in personal property was introduced as HB 4214–4215. MRA supports the legislation but wonders if it goes far enough in addressing the challenges of the commercial personal property tax. Next steps: House Tax Policy Committee. MRA Position: Support.

- Alcohol on rivers: A resolution that seeks to overturn a U.S.D.A Forest Service order banning alcohol consumption on or within 200 feet of the shores of certain Northern Michigan rivers (the National Wild and Scenic River sections of the AuSable, Manistee, and Pine rivers) was introduced as SR 12. MRA members have expressed concerns about the impact this will have on nearby stores and is working with the resolution sponsor and others to see this order overturned. Next steps: Senate Natural Resources Committee. MRA Position: Support.

- Broadband funding: Legislation to exempt broadband companies’ equipment from the Personal Property Tax and to provide additional funding for broadband expansion in underserved areas was introduced as HB 4268, HB 4288 and SB 163. HB 4288 would create a grant program to award funds to local governments or educational institutions to own, purchase, construct, operate or maintain a communications network. Next steps: House Communications and Technology Committee. MRA Position: Under review.

- Daylight Savings Time: As we just set back our clocks for Daylight Savings Time this weekend, it’s only fitting that the legislature has once again introduced a bill to end Michigan’s participation in Daylight Savings Time as HB 4303. Similar bills attracted a lot of discussion last session but little movement.Next steps: House Commerce and Tourism Committee. MRA Position: Monitoring.

- Texting while driving: Several bipartisan bills, introduced as HB 4181, 4198–4199, would increase penalties on drivers who send texts or other messages while driving. Texting while driving is already illegal and drivers can receive both that penalty and distracted driving charges which carries a larger fine and impact on one’s driving record. Next steps: House Transportation Committee. MRA Position: Monitoring.