In July, the National Retail Federation (NRF) released their anticipated back-to-school spending data with big numbers – their economists expect spending to reach a record $41.5 billion, up from $36.9 billion in 2022 and the previous record high of $37.1 billion in 2021.

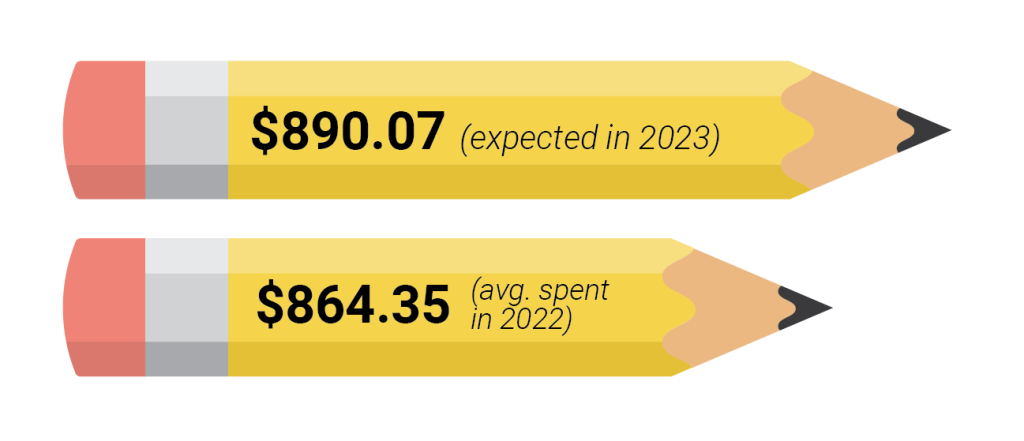

To break those large numbers down by household, the NRF expects each household to dish out $890.07 on back-to-school shopping, up from $864.35 in 2022, a previous record.

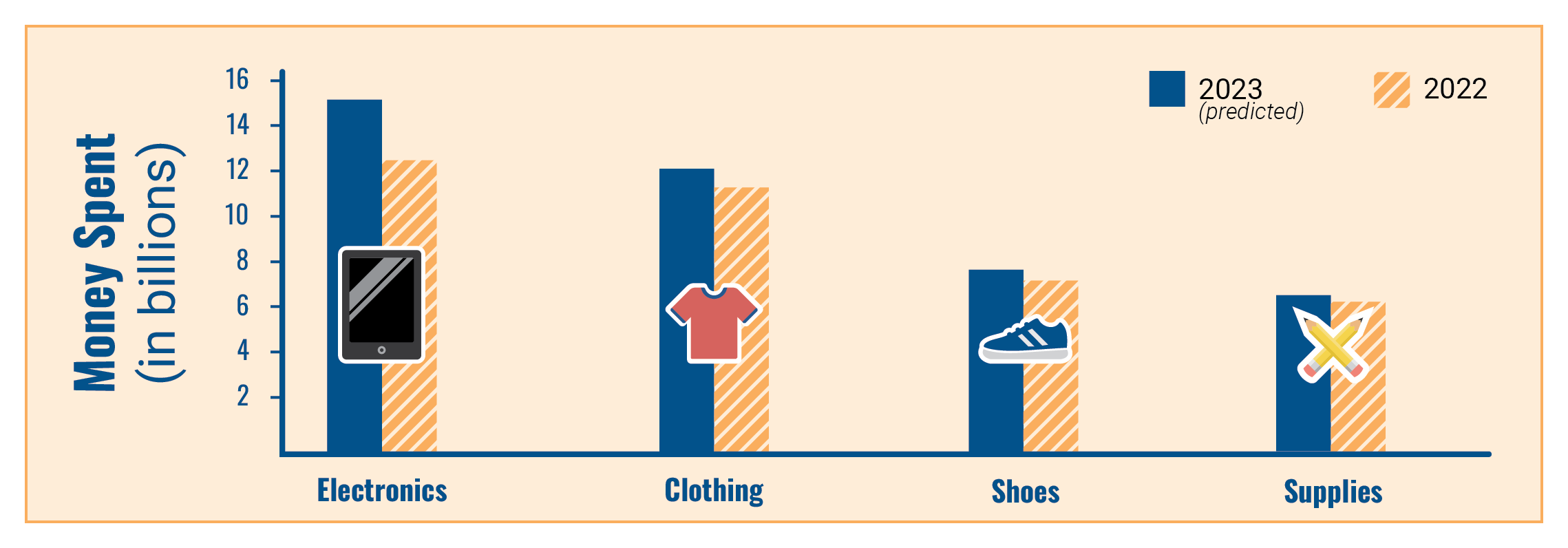

What’s Being Purchased

Top spending amounts per category in 2023 set all-time records

- $15.2 billion on Electronics and computer-related equipment, versus $12.5 billion in 2022

- $12 billion on clothing and accessories, excluding shoes, versus $11.2B in 2022

- $7.8 billion on shoes, versus $7.2 billion in 2022

- $6.5 billion on school supplies, versus 6 billion in 2022

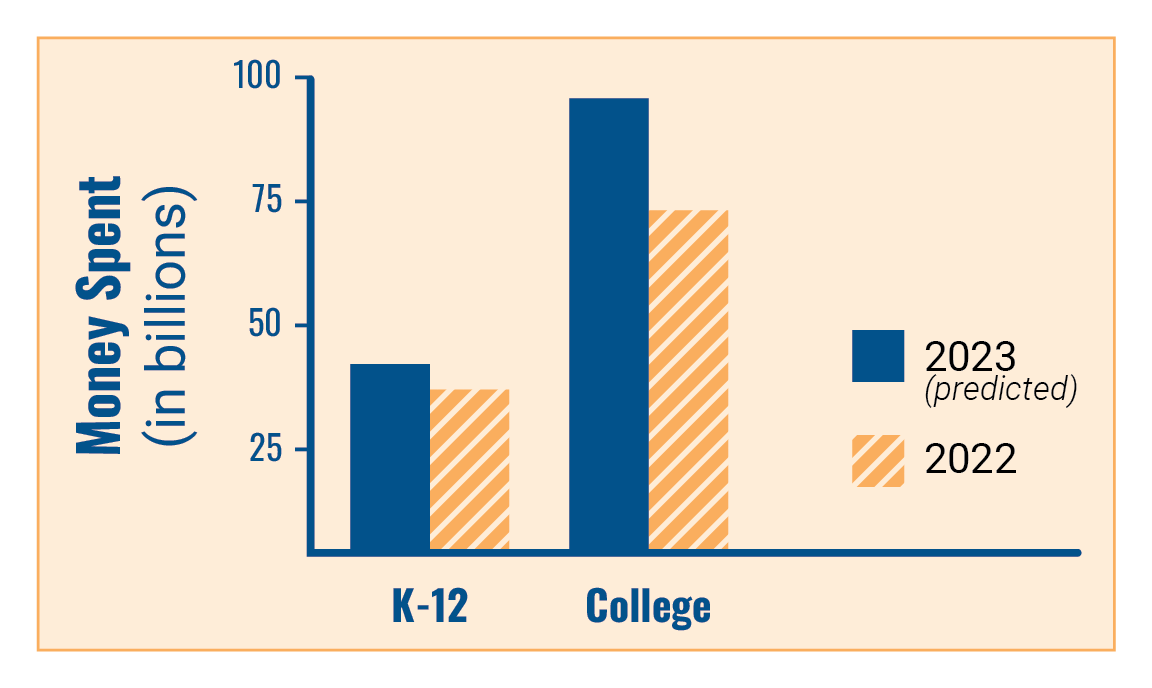

K-12 vs. College

NRF’s survey also includes data on back-to-college spending, which is expected to hit $94 billion, up nearly $20 billion over 2022’s record year of $73.9 billion.

The NRF anticipates per household spending on back-to-college to come in at $1,366.95, up from 2022’s $1,199.42 and 2021’s record-high of $1,200.32.

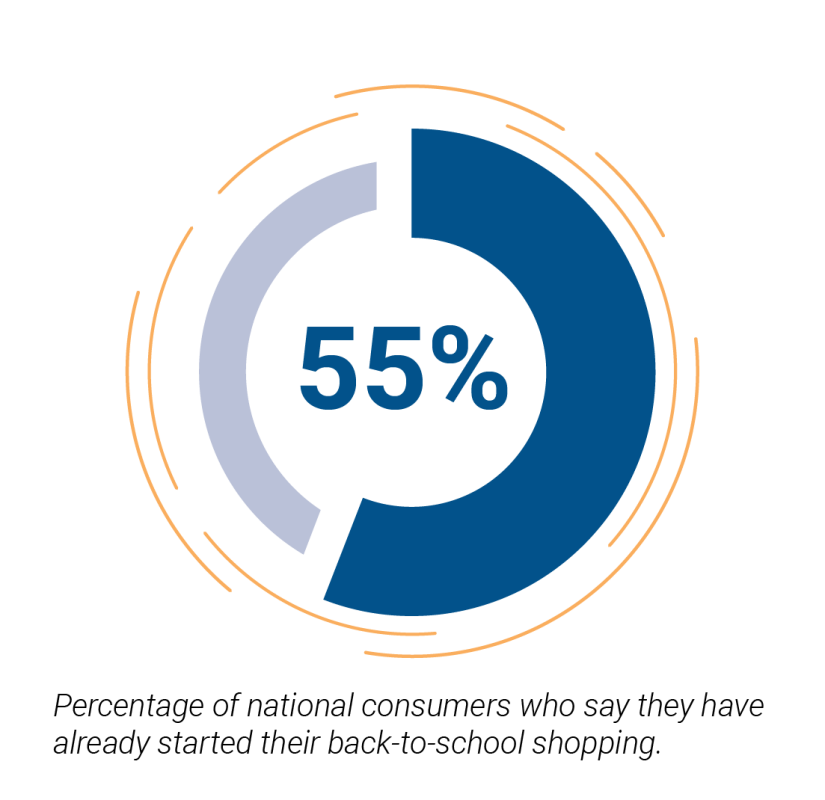

How early did consumers start shopping?

According to the NRF survey, as of early July, 55% of consumers shopping for back-to-class said they’ve already started. This is similar to 2022, but up from 44% in 2019. While consumers report they have started shopping early, as of early July, 85% said they still have at least half of their shopping left to do.

Michigan Retail Index Data

Michigan Retail Index Data

According to the Michigan Retail Index survey, done in conjunction with the Federal Reserve Bank of Chicago’s Detroit branch, the June Retail Index survey came in at 56.0, an increase over May’s 50.7. Half (50%) of Michigan retailers surveyed reported a sales increase over May. Thirty-four percent (34%) noted a decrease, and 16% reported no change. The 100-point Index provides a snapshot of the state’s overall retail industry. Index values above 50 generally indicate positive activity, the higher the number, the stronger the activity.

Fifty-three percent (53%) of retailers predict their sales will continue to rise through September, and 13% said they expect their sales to decline. Thirty-four percent (34%) anticipate no change. That results in a 78.0 Index rating, a significant rise from last month’s prediction Index rating of 66.7.

Take the latest survey and share your data with us here.